All Categories

Featured

Table of Contents

These commissions are built right into the acquisition rate, so there are no hidden charges in the MYGA agreement. That suggests purchasing several annuities with staggered terms.

For instance, if you opened up MYGAs of 3-, 4-, 5- and 6-year terms, you would have an account developing each year after 3 years. At the end of the term, your cash can be withdrawn or placed right into a brand-new annuity-- with good luck, at a greater rate. You can likewise use MYGAs in ladders with fixed-indexed annuities, an approach that seeks to take full advantage of return while also shielding principal.

As you compare and comparison images offered by different insurance coverage business, take into account each of the locations provided over when making your final choice. Recognizing agreement terms along with each annuity's benefits and drawbacks will allow you to make the most effective decision for your monetary situation. annuities accounting. Assume meticulously about the term

Fixed Annuity Rates 2016

If passion rates have increased, you might desire to secure them in for a longer term. Throughout this time, you can obtain all of your cash back.

The company you purchase your multi-year guaranteed annuity through accepts pay you a set rate of interest on your premium quantity for your chosen time period. best retirement annuities. You'll obtain passion credited regularly, and at the end of the term, you either can restore your annuity at an upgraded price, leave the cash at a fixed account price, choose a negotiation alternative, or withdraw your funds

Because a MYGA offers a set rate of interest price that's assured for the agreement's term, it can give you with a foreseeable return. With rates that are established by agreement for a certain number of years, MYGAs aren't subject to market fluctuations like other financial investments.

When Do Annuity Payments Start

Annuities typically have penalties for early withdrawal or surrender, which can limit your ability to access your money without charges - variable annuity insurance. MYGAs might have lower returns than supplies or mutual funds, which can have higher returns over the long term. Annuities typically have abandonment costs and management prices.

MVA is an adjustmenteither positive or negativeto the accumulated worth if you make a partial surrender over the free quantity or totally surrender your contract during the abandonment cost period. Rising cost of living threat. Due to the fact that MYGAs offer a set rate of return, they may not equal rising cost of living over time. Not guaranteed by FDIC.

Fyi Annuity

MYGA rates can transform typically based on the economic situation, but they're typically greater than what you would certainly make on a savings account. Need a refresher course on the four fundamental kinds of annuities? Find out more how annuities can guarantee a revenue in retired life that you can't outlive.

If your MYGA has market value modification provision and you make a withdrawal prior to the term mores than, the firm can change the MYGA's abandonment worth based upon changes in interest rates. If prices have actually enhanced because you bought the annuity, your abandonment value might decrease to account for the greater rates of interest setting.

Nevertheless, annuities with an ROP stipulation commonly have reduced surefire passion rates to counter the business's possible danger of having to return the costs. Not all MYGAs have an MVA or an ROP. Terms rely on the business and the agreement. At the end of the MYGA duration you have actually chosen, you have three alternatives: If having actually an ensured rate of interest for a set variety of years still aligns with your financial technique, you just can renew for another MYGA term, either the very same or a various one (if offered).

Types Of Annuities Insurance

With some MYGAs, if you're unsure what to do with the cash at the term's end, you don't need to do anything. The built up worth of your MYGA will relocate into a dealt with account with an eco-friendly 1 year rate of interest determined by the business. You can leave it there until you choose your following step.

While both offer assured prices of return, MYGAs typically supply a higher rate of interest rate than CDs. MYGAs grow tax obligation deferred while CDs are tired as earnings annually. Annuities grow tax deferred, so you don't owe revenue tax on the incomes up until you withdraw them. This allows your incomes to intensify over the regard to your MYGA.

This minimizes the possibility for CDs to gain from long-lasting substance interest. Both MYGAs and CDs commonly have very early withdrawal fines that might affect temporary liquidity. With MYGAs, surrender charges might use, depending on the type of MYGA you pick. You might not just lose passion, but also principalthe money you originally contributed to the MYGA.

What Does Annuitizing An Annuity Mean

This indicates you might weary yet not the principal quantity added to the CD.Their conventional nature usually appeals extra to people that are approaching or already in retired life. They may not be best for everyone. A might be appropriate for you if you desire to: Make use of an assured rate and lock it in for a duration of time.

Benefit from tax-deferred incomes development (annuity rates 2022). Have the option to pick a negotiation choice for an assured stream of earnings that can last as long as you live. Just like any type of sort of financial savings automobile, it's essential to meticulously assess the terms of the item and speak with to identify if it's a sensible option for achieving your specific demands and goals

Variable Annuity Returns

1All assurances including the death benefit payments depend on the cases paying ability of the issuing business and do not apply to the financial investment efficiency of the hidden funds in the variable annuity. Properties in the underlying funds undergo market threats and might vary in value. Variable annuities and their underlying variable financial investment options are offered by prospectus only.

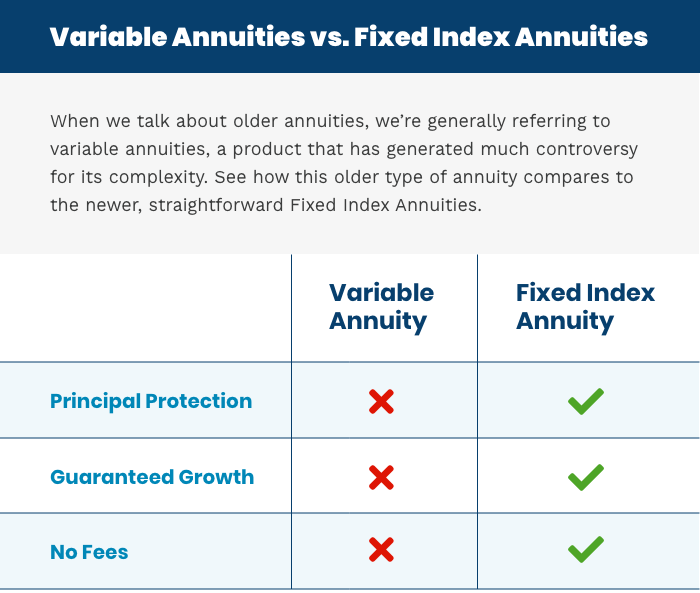

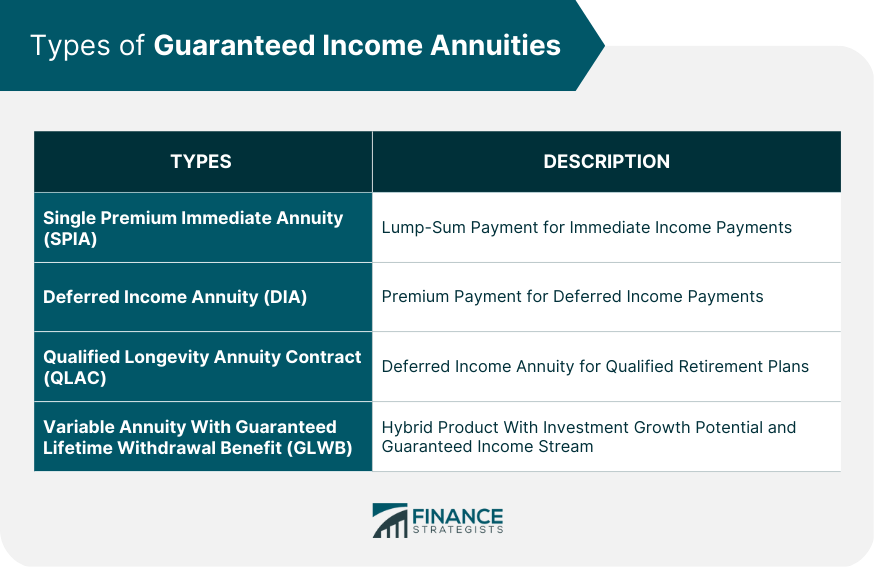

Fixed indexed annuities offer guaranteed returns, while variable annuities provide greater growth potential. Certified advisors clarify the key benefits of each type, helping you make informed decisions.

Variable annuities are better for those seeking higher returns, with potential for greater earnings. A financial advisor can analyze your needs and help you choose confidently (annuities for cash value accumulation agents explain). Immediate annuities, offering lifetime income, are a preferred choice for those looking to simplify their post-retirement finances. Speak with an annuity expert to learn more about fixed and variable annuities

This and various other info are included in the syllabus or recap prospectus, if available, which may be gotten from your investment expert. Please read it before you invest or send out money. 2 Ratings are subject to change and do not apply to the underlying investment choices of variable products. 3 Existing tax law undergoes interpretation and legal modification.

Annuity Pension Rates

People are urged to seek certain suggestions from their personal tax or legal advise. By providing this material, The Guardian Life Insurance Firm of America, The Guardian Insurance & Annuity Business, Inc .

Table of Contents

Latest Posts

Understanding Fixed Vs Variable Annuity Pros Cons Key Insights on Fixed Vs Variable Annuity Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing the Right Fin

Decoding Fixed Annuity Or Variable Annuity Key Insights on Fixed Income Annuity Vs Variable Annuity Defining Annuities Fixed Vs Variable Pros and Cons of Variable Annuities Vs Fixed Annuities Why Fixe

Exploring Fixed Indexed Annuity Vs Market-variable Annuity A Comprehensive Guide to Annuity Fixed Vs Variable What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Choo

More

Latest Posts